INSIGHTS

How Startup Board Approvals Actually Work: Voting at Meetings vs Written Consents

There are 2 clean ways a Board of Directors takes action in a Delaware corporation. Both can be valid. Both can be sloppy if you do them casually. And both become very real later when you are fundraising, doing diligence, issuing equity, or selling the company.

What Founders Must Lock In Before Losing Majority Ownership

A preferred round can drop your equity stake below 50 percent even when you negotiate well. If you are reviewing a term sheet that will reduce you to a minority holder, this is the moment to pause and design the structure that will govern the company for years.

How to Calculate Stock Option Grants in a Startup

Stock options are not a direct substitute for cash compensation. So, if you want to avoid common mistakes founders make when evaluating option value and incentivizing employees and contractors with equity compensation, then you need to learn how to structure a fair option grant.

Why Founders Should Be Cautious with Employment Agreement Templates

Employment law is not just complex, it's also highly state-specific. A clause that’s standard in one state may be unenforceable (or even illegal) in another. And mistakes in this area often don’t become apparent until it’s too late, whether in the form of a dispute, a government audit, or a failed diligence process during a funding round.

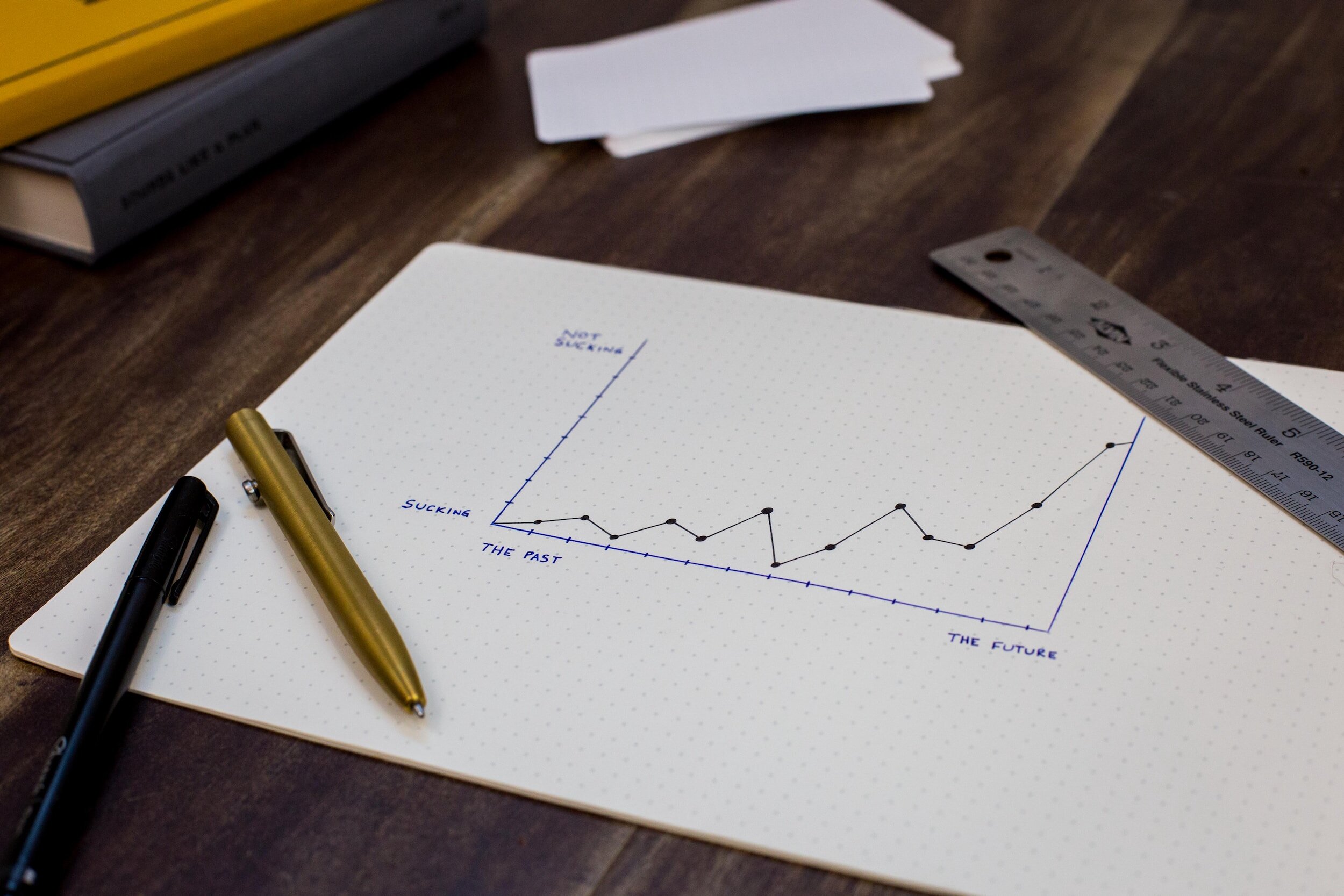

Why Founders Burn Out (and How to Reconnect with What Matters)

Here are a few practical ways for startup founders to shift out of survival mode and reconnect with themselves (and their companies) from a place of clarity and grounded confidence.

Cumulative vs. Non-Cumulative Dividends in Preferred Stock Fundraising Rounds

Not all dividend provisions are created equal, and the difference between cumulative and non-cumulative dividends can significantly affect how investor economics work at exit.

How to File an 83(b) Election: A Crucial Step for Startup Founders

If you’ve just incorporated your startup and received restricted stock as a founder, congratulations—you’ve taken a major step in building your company. But don’t stop there. One of the most important early tax decisions you’ll make is whether to file an 83(b) election with the IRS. If you don’t, you could face a hefty tax bill down the road.

How to Set an Exercise Price in an Option Grant

If you’re an early-stage startup founder thinking about granting stock options, one of the first terms you’ll need to set is the exercise price—also called the strike price. This is the price at which a recipient can purchase a share of stock when they exercise their option. Sounds simple enough, right? But setting it too low can trigger serious tax consequences, and setting it too high can reduce the incentive value of the options. Here's how to get it right—especially when you’re still pre-revenue or pre-funding and not ready to pay for a formal 409A valuation.

Understanding Qualified Small Business Stock (QSBS) and When Investors Actually Benefit

For startup founders and investors alike, the potential tax benefits of Qualified Small Business Stock (QSBS) can be highly attractive. QSBS treatment, governed by Section 1202 of the Internal Revenue Code, offers a significant tax exclusion on capital gains—potentially up to 100%—when stockholders sell their shares. But it only applies in certain contexts.

Tax Implications of ISO Exercises: What Startup Founders and Employees Need to Know

Incentive Stock Options (ISOs) are a common form of equity compensation offered to employees of startups and growing companies. For employees, ISOs often represent the potential for significant financial upside. However, the tax implications of exercising ISOs can be complex, particularly when the Alternative Minimum Tax (AMT) comes into play.

How to Pitch to Investors: Five Key Tips for Early-Stage Startup Founders

Securing funding is crucial for early-stage startup founders, and delivering a compelling pitch can make all the difference. In this blog post, we explore five key tips for pitching to investors: make them think with thought-provoking questions, share a personal story to connect on a deeper level, evoke emotions by being raw and vulnerable, present surprising facts to highlight urgency, and maintain honesty by admitting what you don't know. By following these strategies, founders can create a memorable and impactful narrative that resonates with investors and builds lasting relationships.

Milestones Investments in Life Science Startup Fundraising Rounds

Explore the importance of milestones in investment documents for life science startups. Learn how to structure measurable goals that align with business objectives, enhance investor communication, and attract funding opportunities. Understand the significance of clinical, financial, operational, and market entry milestones in preferred stock rounds. Optimize your startup's fundraising strategy with clear, relevant milestones.

The Legal and Tax Ramifications of Failing to File an 83(b) Election: A Guide for Startup Founders

Discover the legal ramifications of not filing an 83(b) election for startup founders. Learn about the tax consequences for stockholders and companies, especially W2 employees, related to restricted stock vesting. Explore options to address missed filings and strategies to structure equity compensation, including the benefits of stock options versus restricted stock grants.

Navigating Fundraising Without Losing Yourself: Maintaining Well-being as a Startup Founder

The startup fundraising process is undoubtedly challenging for founders, but it doesn’t have to come at the expense of your well-being. By remembering that all opinions are subjective, trusting your vision, and prioritizing your mental and physical health, you can navigate the pressures of fundraising without losing yourself.

Federal Trade Commission Bars Employers from Enforcing Non-Compete Agreements

Understand the details and impact of the Federal Trade Commission’s new rule to bar employers from enforcing non-compete agreements

Navigating Section 1244: Tax Relief for Startup Stock Losses

Understand how startup investors and other stockholders can gain some tax relief under Section 1244 of the Internal Revenue Code when a startup losses value.

How (and When) to File Delaware Corporate Franchise Taxes

Don’t overpay Delaware franchise taxes! Use this comprehensive guide to calculate the exact amount of franchise taxes your Delaware corporation owes.

Qualified Small Business Stock for Startups

Qualified Small Business Stock comes with substantial tax incentives—if companies and stockholders satisfy all IRS requirements.

Corporate Transparency Act: Beneficial Ownership Information Filing Requirements

How to comply with the Corporate Transparency FinCen filing requirements.

What is a 409A Valuation?

Understand the key purposes of a 409A valuation for a startup company.